8 Inspiring How To Figure Your Debt To Income Ratio Full

8 Fail Proof How To Figure Your Debt To Income Ratio - The ratio is expressed as a percentage, and lenders use it. And credit history are two important financial health factors lenders consider when determining if they will lend you money.

Your debt 💰 to ratio is an important factor to . Wondering how to figure out your debt to income ratio?

Your debt 💰 to ratio is an important factor to . Wondering how to figure out your debt to income ratio?

How to figure your debt to income ratio

13 Strategy How To Figure Your Debt To Income Ratio. Let's walk through some examples!🎧 listen to the podcas. Read up on how to calculate your dti. We’ll help you understand what it. How to figure your debt to income ratio

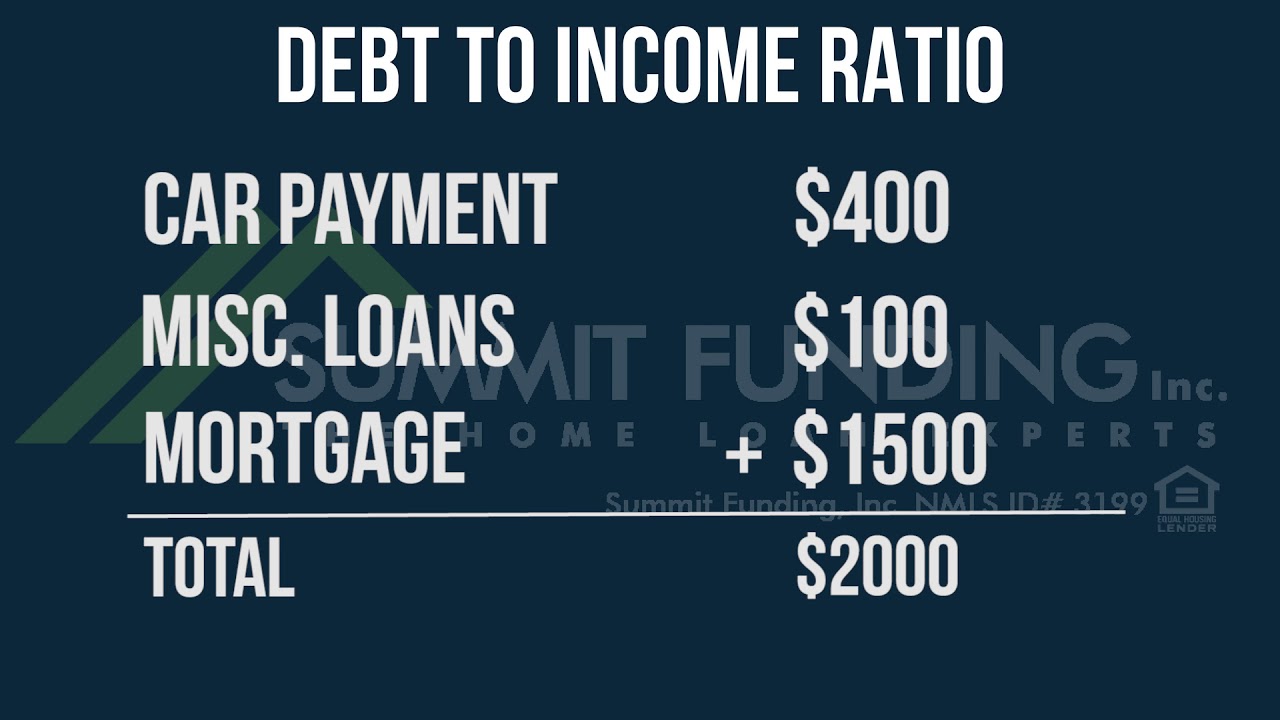

Calculating your dti ratio is simple: For example, if each month you pay $1,000 for your mortgage payment, $250 for your auto loan, $100 for your student loan and $200 for various other debt, your total monthly debt obligation—the sum of all your monthly. To calculate his dti, add up his monthly debt and mortgage payments ($1,600) and divide it by his gross monthly income ($5,000) to get 0.32. How to figure your debt to income ratio

What debt to income ration do each type of loan require. Generally speaking, you should aim for a credit utilization ratio of below 30%. You can prepare both your credit score and debt ratio early on to How to figure your debt to income ratio

This number will be compared against your income to calculate your back end ratio. To calculate your estimated dti ratio, simply enter your current income and payments. Take the time to figure out your dti and where you stand before thinking about buying a house. How to figure your debt to income ratio

While we do not moderate posts, we reserve the right to delete. So this includes payments to student loans , credit cards, car loans, personal loans, mortgages or any other debts you have. Total your monthly bills and divide that number by your gross monthly income, or your pay before taxes or other deductions. How to figure your debt to income ratio

To determine your dti ratio, simply take your total debt figure and divide it by your income. What to do • complete the debt log” to figure out your total monthly debt • Let's say you spend $1,200 on rent, $500 on a credit card bill and $150 on an auto loan, or $1,850 total on monthly debt payments. How to figure your debt to income ratio

This means money is being freed up to use on other things like saving, expenses, and emergencies. This calculator is for educational purposes only and is not a denial or approval of credit. What's your debt to income ratio? How to figure your debt to income ratio

Do you know why it's important? Multiply that by 100 to get a percentage. Your dti reveals how much debt you owe compared to the income you earn. How to figure your debt to income ratio

For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your dti is $2,000 ÷ $6,000, or 33 percent. And can you qualify for a mortgage with your debt to income ratio? How to figure your debt to income ratio

Debt To Ratio Formula . And can you qualify for a mortgage with your debt to income ratio?

Debt To Ratio Formula . And can you qualify for a mortgage with your debt to income ratio?

Ratio Calculator for Mortgage Approval DTI . For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your dti is $2,000 ÷ $6,000, or 33 percent.

Ratio Calculator for Mortgage Approval DTI . For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your dti is $2,000 ÷ $6,000, or 33 percent.

NT updates How to Calculate Your Ratio . Your dti reveals how much debt you owe compared to the income you earn.

NT updates How to Calculate Your Ratio . Your dti reveals how much debt you owe compared to the income you earn.

Do you know your Ratio (DTI)? Here's how to . Multiply that by 100 to get a percentage.

Do you know your Ratio (DTI)? Here's how to . Multiply that by 100 to get a percentage.

The Best Debt to Ratio Calculators 2017 Guide . Do you know why it's important?

PPT Money Management 101 PowerPoint Presentation ID . What's your debt to income ratio?