13 Popular How To Dispute Debt Collection Full

9 Unique How To Dispute Debt Collection - Once you dispute the debt, the debt collector must stop all debt _____ collection agency’s name and

Dispute Letter Template For Medical Collections Cover . Consider the timing of the debt collector’s call before deciding to pay or dispute a debt.

Dispute Letter Template For Medical Collections Cover . Consider the timing of the debt collector’s call before deciding to pay or dispute a debt.

How to dispute debt collection

13 Quick How To Dispute Debt Collection. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt. Within 30 days of receiving notice of the debt from the debt collector, you can send a letter to the debt collector disputing the debt and requesting the name and contact information of the original creditor. Reach out to the company the collector says is the original creditor. How to dispute debt collection

Once you (or your financial counsellor or other representative) have notified the debt collector that the debt is in dispute, debt collection activity must stop until this is resolved. You may also be interested in: But the mediator will try to guide each of you toward a settlement. How to dispute debt collection

How do i fight a false collection? The debt collector must stop all debt collection activities until it can “verify” the debt. While the dispute process can often take a while to complete, it How to dispute debt collection

Ask for a goodwill deletion it may be a long shot, especially with collection agencies, but a goodwill deletion request is another option for having debt collections removed from your credit report. If the creditor does not respond or is uncooperative with your complaint, file a dispute letter with each of the three credit agencies, which are transunion, experian, and equifax. The mediator is not like a judge, in that he cannot order you, or the creditor, to do anything. How to dispute debt collection

You can also use the sample dispute letter to discover the name and address of the original creditor. The cfpb’s debt collection rule clarifying certain Debt collection dispute letters will help you along the way, but we will get back to those later. How to dispute debt collection

Dispute the debt if you are certain it is not yours, but do not ignore the letter. Credit and debt dispute letters from www.slideshare.net disputing any negative item on your own is possible — but it's a tedious process. If you dispute the debt, then anytime the collector reports that debt to a credit reporting agency, then they must report that the debt is a disputed debt. How to dispute debt collection

How to dispute a debt page 3 your name and address here date certified mail, return receipt requested no. Because medical collections can have a significant negative impact on your credit scores , try to keep your medical bills from ever going to collections in the first place. The collection account on your credit report will show the original creditor's name and available contact information for the collection agency (not the name of the medical office or provider). How to dispute debt collection

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. Also, a default listing on your credit report should not be made during this period. Mediation is a process where both parties meet with a neutral third party called a mediator. How to dispute debt collection

Right to dispute the debt: Rural law center of new york, inc. You can use this sample dispute letter (pdf) as a model. How to dispute debt collection

Please note that if the account has been written off and sent to a collection. When you receive notification of debt from a collection agency, you can write a debt validation letter. A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount owed. How to dispute debt collection

If the debt collector fails to respond to the dispute, the credit bureau should remove the account since it has not been verified. Contact the original creditor by sending them a credit dispute letter that requests validation of your debt. File a dispute if the information on your collection is inaccurate. How to dispute debt collection

One way to settle a debt collection case is through mediation. How to dispute a collection on a credit report now that you have a better idea of whether it makes sense to dispute a collection, the next step is to learn how to do it. If a debt collector is calling about debt that’s over 6 years old, it might not even be on your credit report anyway. How to dispute debt collection

No, if you dispute the debt in writing within 30 days of the initial communication the debt collector must stop all collection activity until it provides the required verification. The main thing is that if the debt collector cannot make the proof available, they will never cause you a nuisance again. Say you defaulted on a. How to dispute debt collection

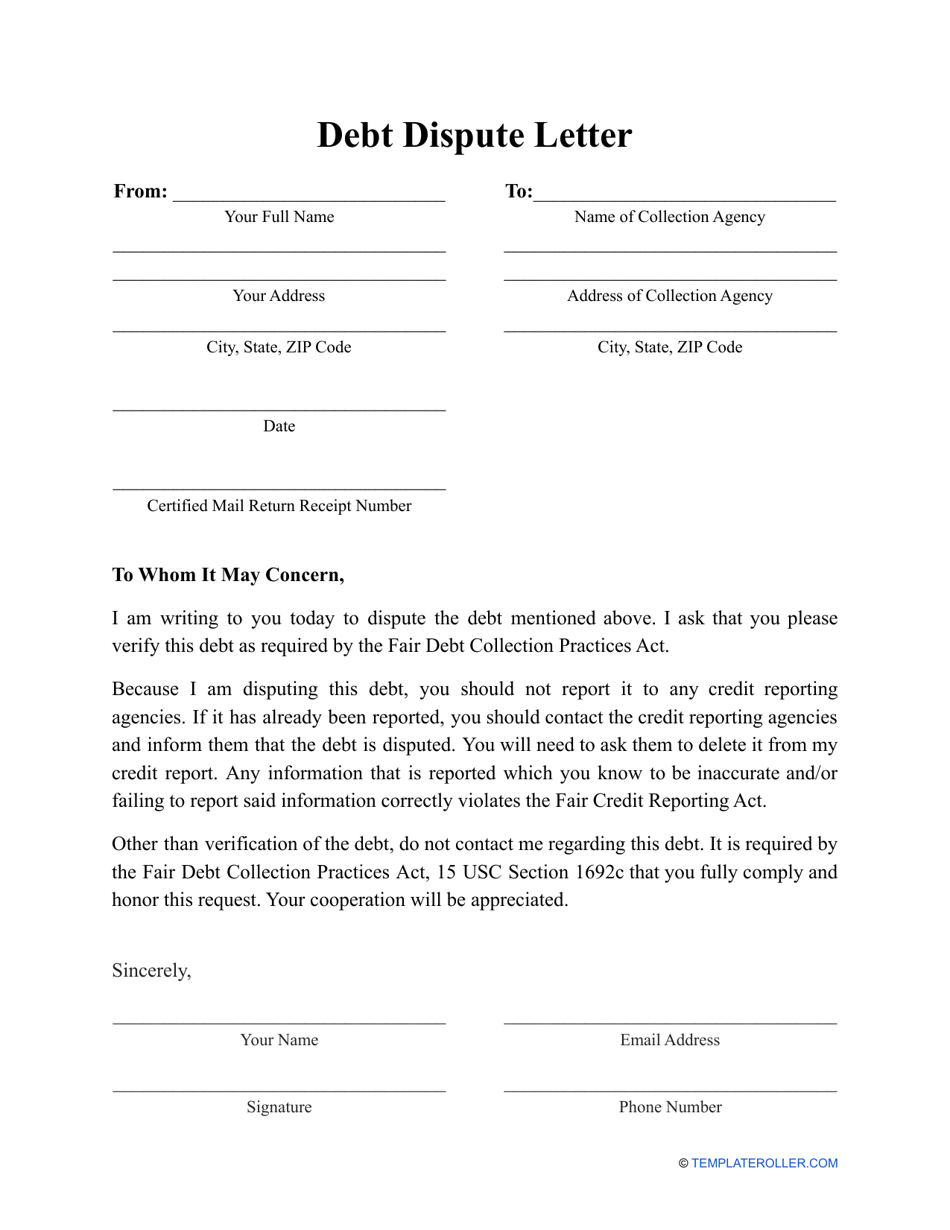

Debt Dispute Letter Mt Home Arts . Say you defaulted on a.

Debt Dispute Letter Template Download Printable PDF . The main thing is that if the debt collector cannot make the proof available, they will never cause you a nuisance again.

Debt Dispute Letter Template Download Printable PDF . The main thing is that if the debt collector cannot make the proof available, they will never cause you a nuisance again.

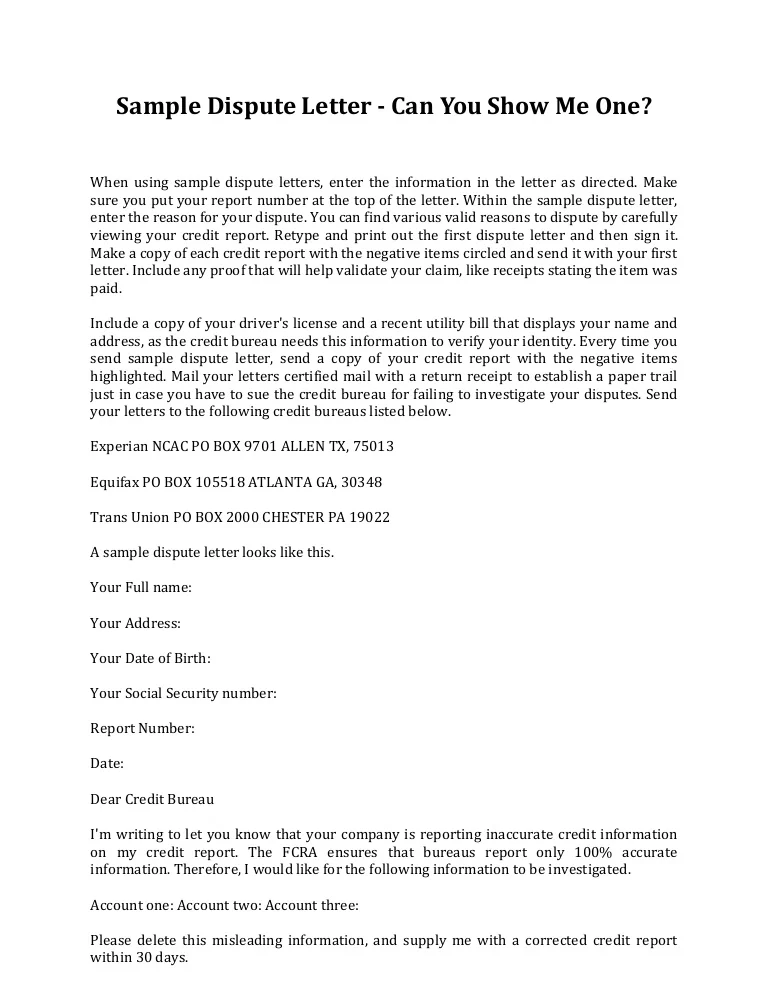

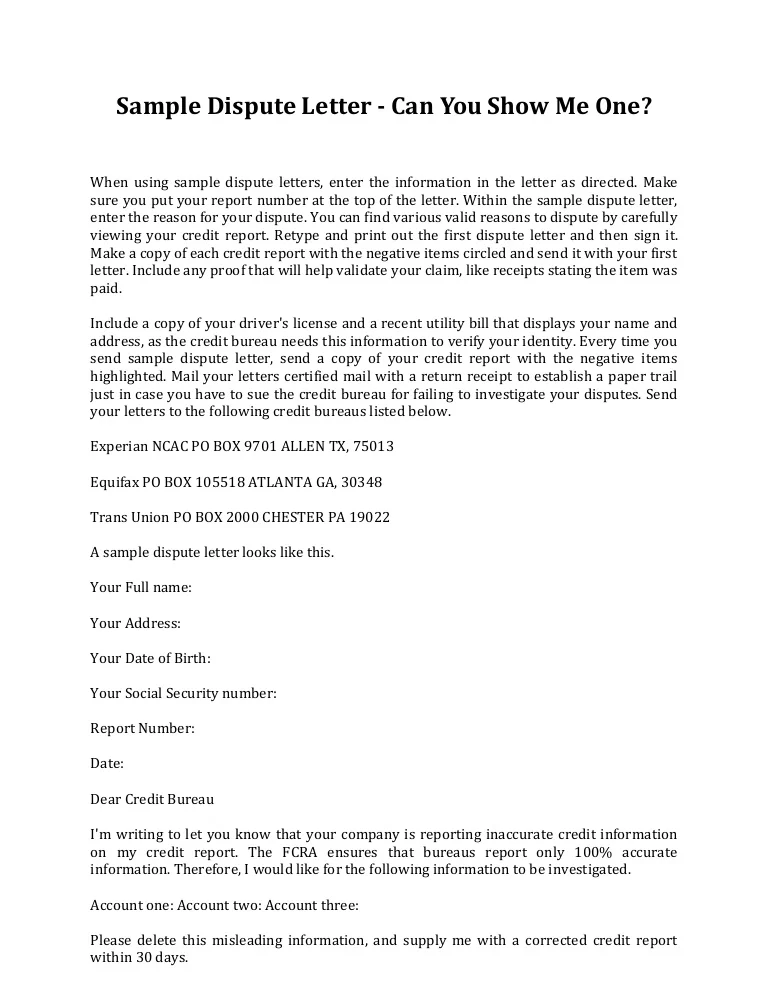

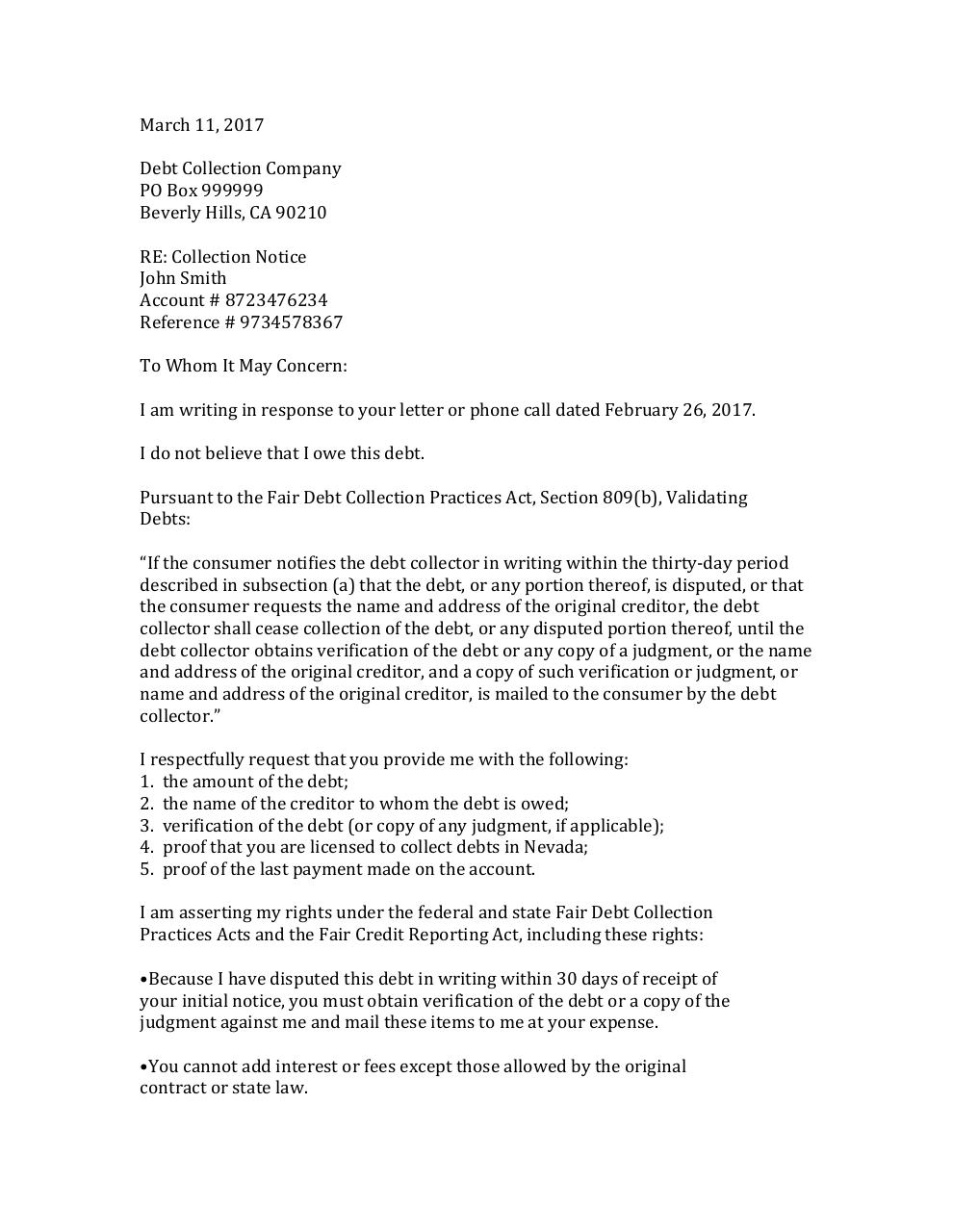

Sample dispute letter can you show me one . No, if you dispute the debt in writing within 30 days of the initial communication the debt collector must stop all collection activity until it provides the required verification.

Sample dispute letter can you show me one . No, if you dispute the debt in writing within 30 days of the initial communication the debt collector must stop all collection activity until it provides the required verification.

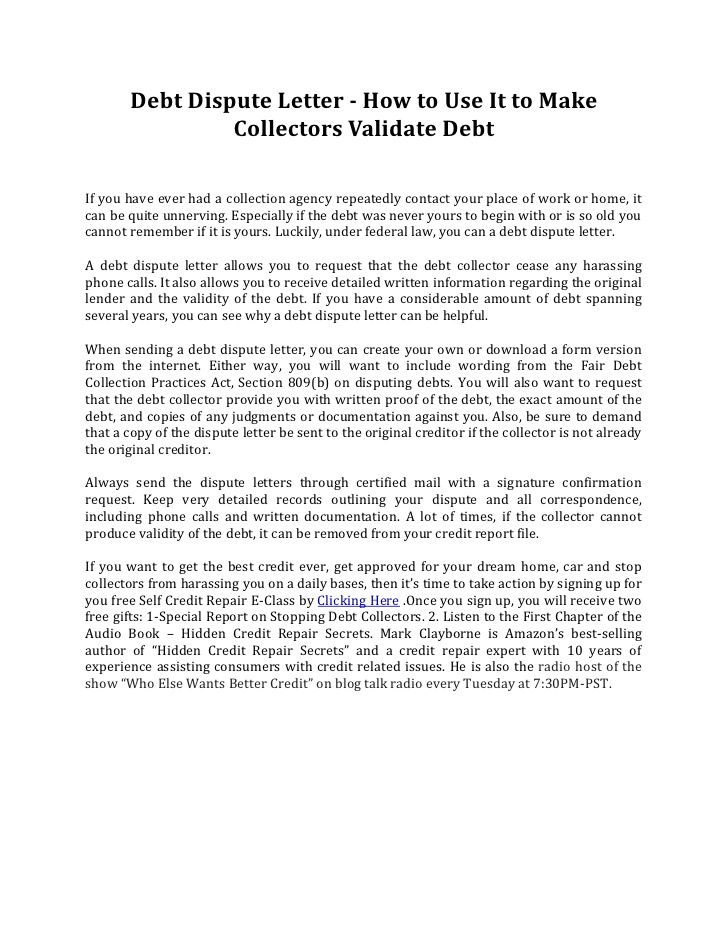

The Significance of a Dispute Letter for Debt Collection . If a debt collector is calling about debt that’s over 6 years old, it might not even be on your credit report anyway.

The Significance of a Dispute Letter for Debt Collection . If a debt collector is calling about debt that’s over 6 years old, it might not even be on your credit report anyway.

How to Dispute a Debt with a Collections Agency Jessi Fearon . How to dispute a collection on a credit report now that you have a better idea of whether it makes sense to dispute a collection, the next step is to learn how to do it.

How to Dispute a Debt with a Collections Agency Jessi Fearon . How to dispute a collection on a credit report now that you have a better idea of whether it makes sense to dispute a collection, the next step is to learn how to do it.

View Dispute Letter Template For Collection Agency Cecilprax . One way to settle a debt collection case is through mediation.

View Dispute Letter Template For Collection Agency Cecilprax . One way to settle a debt collection case is through mediation.