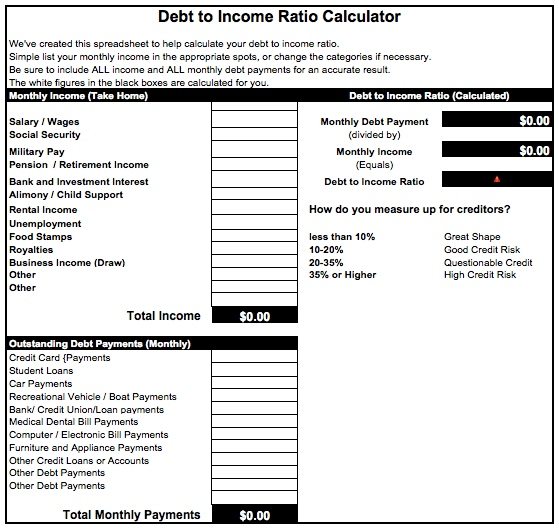

13 Approved How To Calculate My Debt To Income Ratio - For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your dti is. Here’s how the debt ratio is rated:

How to Calculate My Ratio Personal . Its submitted by management in the best.

How to Calculate My Ratio Personal . Its submitted by management in the best.

How to calculate my debt to income ratio

13 Skill How To Calculate My Debt To Income Ratio. To calculate your estimated dti ratio, simply enter your current income and payments. Read up on how to calculate your dti. It shows your total income, total debts, and your debt ratio. How to calculate my debt to income ratio

This calculator is for educational purposes only and is not a denial or approval of credit. If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. This number will be compared against your income to calculate your back end ratio. How to calculate my debt to income ratio

If you'd rather avoid manual calculations, feel free to. While we do not moderate posts, we reserve the right to delete. Is my debt to income ratio accounted for when i obtain a decision in principle? How to calculate my debt to income ratio

To calculate the ratio, divide your monthly debt payments by your monthly income. As a quick example, if someone's monthly income is $1,000 and they spend $480 on debt each month, their dti ratio is 48%. Then, multiply the result by 100 to come up with a percent. How to calculate my debt to income ratio

Then divide that number by your gross monthly income amount. How to calculate your ratio the debt to income ratio is a good way for creditors to compare your income with the amount of debt you currently have. To calculate your dti ratio, divide your ongoing monthly debt payments by your monthly income. How to calculate my debt to income ratio

Most lenders do not check debt to income ratio at the agreement in principle stage of the application, though some do. To determine your dti ratio, simply take your total debt figure and divide it by your income. The resulting number is your dti. How to calculate my debt to income ratio

And credit history are two important financial health factors lenders consider when determining if they will lend you money. It must not exceed 39%. Multiply that by 100 to get a percentage. How to calculate my debt to income ratio

If they had no debt, their ratio is 0%. Most creditors use this tool to determine if 43 percent to 49 percent. How to calculate my debt to income ratio

This calculator will give you both. Here are a number of highest rated how to determine debt to income ratio pictures upon internet. Understand all factors that go into your dti & what a good debt. How to calculate my debt to income ratio

It allows lenders to determine the likelihood that you can afford to repay a loan. We identified it from reliable source. Mortgage professionals use 2 main ratios to decide if borrowers can afford to buy a home: How to calculate my debt to income ratio

To calculate his dti, add up his monthly debt and mortgage payments ($1,600) and divide it by his gross monthly income ($5,000) to get 0.32. Under the heading “results,” you can see a pie chart of your debt to income ratio. We’ll help you understand what it. How to calculate my debt to income ratio

How to determine debt to income ratio. Debt to income ratio calculator: For instance, if you pay $2,000 a month for a mortgage, $300 a month for an auto loan and $700 a month for your credit card balance, you have. How to calculate my debt to income ratio

As a general rule, to qualify for a mortgage, your dti ratio should not exceed 36% of your gross. 37 percent to 42 percent. Sometimes this does lead to a mortgage application being rejected despite a. How to calculate my debt to income ratio

Gds is the percentage of your monthly household income that covers your housing costs. Gross debt service (gds) and total debt service (tds). For example, if each month you pay $1,000 for your mortgage payment, $250 for your auto loan, $100 for your student loan and $200 for various other debt, your total monthly debt obligation—the sum of all your monthly. How to calculate my debt to income ratio

Debt to Ratio Calculator Template for Numbers . For example, if each month you pay $1,000 for your mortgage payment, $250 for your auto loan, $100 for your student loan and $200 for various other debt, your total monthly debt obligation—the sum of all your monthly.

Debt to Ratio Calculator Template for Numbers . For example, if each month you pay $1,000 for your mortgage payment, $250 for your auto loan, $100 for your student loan and $200 for various other debt, your total monthly debt obligation—the sum of all your monthly.

How Can I Figure Out My Debt To Ratio . Gds is the percentage of your monthly household income that covers your housing costs.

How Can I Figure Out My Debt To Ratio . Gds is the percentage of your monthly household income that covers your housing costs.

How To Fix Your Debt To Ratio Debt Ratio Formula . Sometimes this does lead to a mortgage application being rejected despite a.

How To Fix Your Debt To Ratio Debt Ratio Formula . Sometimes this does lead to a mortgage application being rejected despite a.

What Is My Debt to Ratio Calculator? . 37 percent to 42 percent.

What Is My Debt to Ratio Calculator? . 37 percent to 42 percent.

Mortgage Calculator with Taxes Insurance PMI HOA & Extra . As a general rule, to qualify for a mortgage, your dti ratio should not exceed 36% of your gross.

Mortgage Calculator with Taxes Insurance PMI HOA & Extra . As a general rule, to qualify for a mortgage, your dti ratio should not exceed 36% of your gross.