7 Quick How To Apply For An Itin Work

9 Easy How To Apply For An Itin - Applying by mail or applying in person. Irs issues itins to individuals who are required to have a u.s.

ITIN application YouTube . How to apply for an itin.

ITIN application YouTube . How to apply for an itin.

How to apply for an itin

13 Absolutely How To Apply For An Itin. Taxpayer identification number but who do not have, and are not eligible to obtain, a social security number (ssn) from the social security administration (ssa). If you’re trying to apply for a new itin, you need one identification documentation and two supporting documentation. The irs allows you to apply for an itin at the same time you fill out your tax return and file your taxes. How to apply for an itin

In both situations, the irs requires you to provide at least two documents from the following list of identification: And the answer is yes, absolutely. When applying on your own, with a tax assistant center, or a cpa, it will take twice… or more. How to apply for an itin

In fact, that’s the whole reason why the itin was actually brought into effect by the irs in 1996. There are two ways a child can obtain an itin. Hey everyone, this is sina bonabi here from ein express. How to apply for an itin

However, the speed in which it takes to get an itin number depends on the volume of inquiries the irs receive — it can take nine to eleven weeks during busy times. Now, if you don’t have a valid passport, the irs does have a list of alternate acceptable identification. Room and board scholarships, lottery winnings, dividend payments, etc.) but who are not eligible for a social security number (ssn) because they are not employed need to apply for an individual taxpayer identification number (itin) in order to file. How to apply for an itin

Federal income tax return, proof of identity, and proof of foreign status in the u.s. Just because you’re an illegal immigrant does not mean they do not apply for an itin. If you are a foreigner and you formed. How to apply for an itin

It’s being the dependent of a person who needs to claim them or being the spouse of a us citizen or a us resident alien who needs to claim them on their taxes, that qualifies them to be able to get an itin. How to apply for a new itin. Taxpayer identification number but who do not have, and are not eligible to obtain a social security number (ssn). How to apply for an itin

The first option is the simplest way to get an itin for your child. Tax filing or informational reporting requirement. You only need to apply for an itin if your spouse is required to have one. How to apply for an itin

The itin application process is relatively simple, and you can apply any time of the year. How to apply for an individual taxpayer identification number an individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. Obtaining an itin from abroad. How to apply for an itin

And outside of tax season, it’s the same drill. Get itin number under normal circumstances. You’ll also need to provide original or certified copies of. How to apply for an itin

After you apply for an itin and qualify for an itin number, you could receive a letter from the irs assigning your tax identification number in as early as seven weeks. Tax filing or international reporting obligation. Hey, so today we’re going to be talking about how to get itin for canadians. How to apply for an itin

You have two options on how to proceed: That identification documentation, traditionally, is satisfied with a valid passport. The irs issues itins to individuals who are required to have a u.s. How to apply for an itin

After your child is issued an itin, when filing and reporting taxes, you can claim him/her as a dependent. The online itin form is a simple way for your child to receive an itin. However, both processes can be used for biological and adopted children under the age of 18, although some additional documentation is required for. How to apply for an itin

And if you do have income that you are making, you are allowed to report it and you pay tax on it or try to pay tax on it. You’re not supposed to do them separately because oftentimes, the dependent or the spouse doesn’t qualify to apply for an itin on their own. During normal times, the best way to get an itin quickly, inside the tax season (january to april 15), is through a certified acceptance agent (caa). How to apply for an itin

Who should apply for an itin? Students who receive taxable income as determined by the internal revenue service (i.e. An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. How to apply for an itin

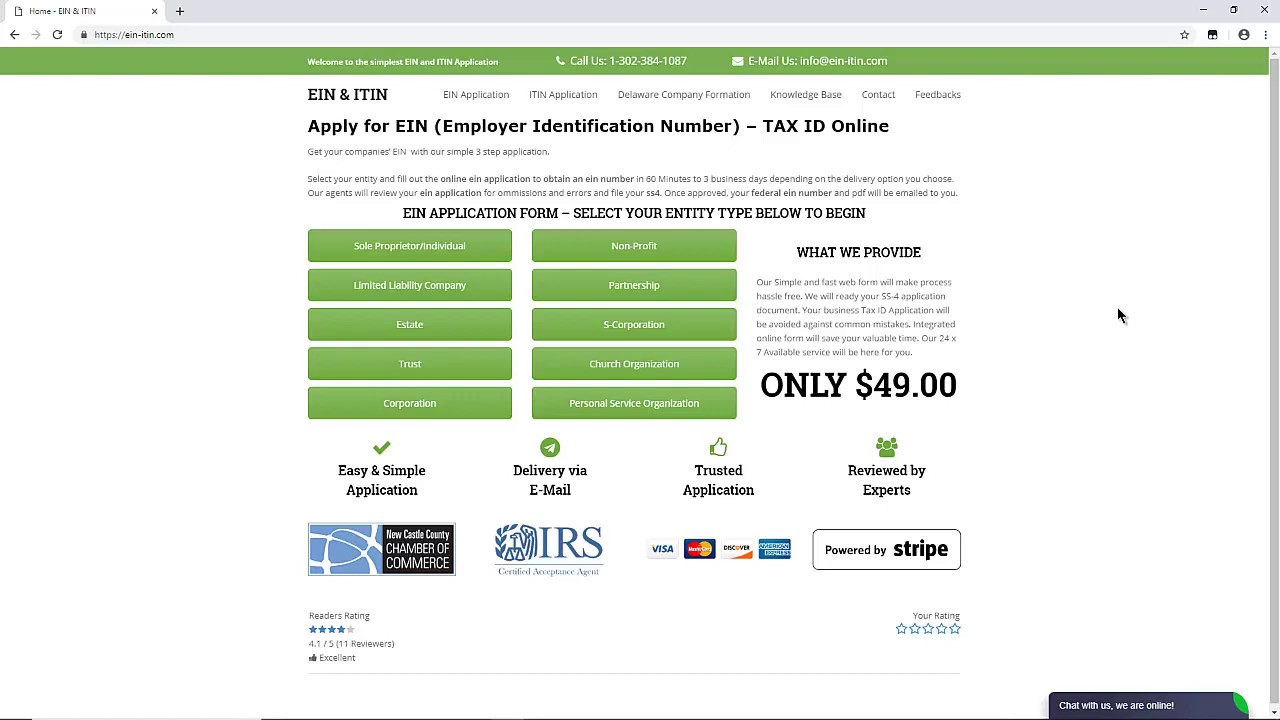

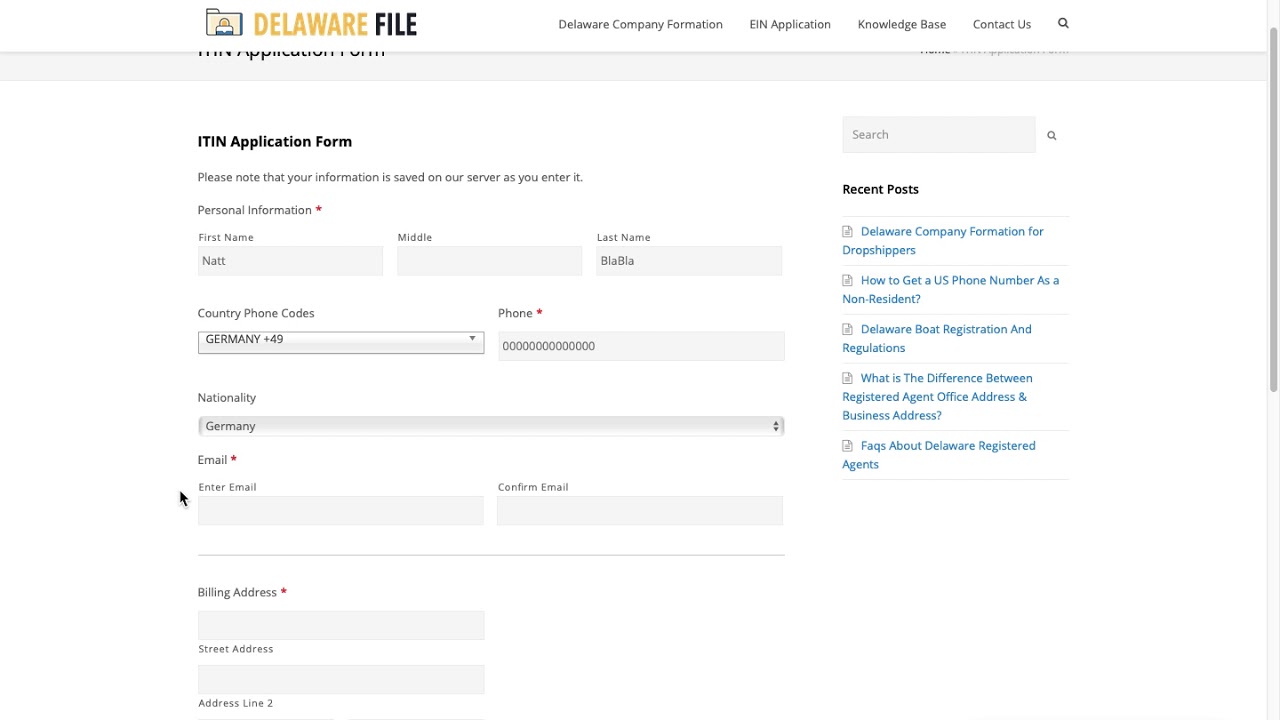

How To Get ITIN Number Online Without SSN? Getting ITIN . An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

How To Get ITIN Number Online Without SSN? Getting ITIN . An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

INDIVIDUAL AND CORPORATE TAX ID PETRALEX AGENCY . Students who receive taxable income as determined by the internal revenue service (i.e.

INDIVIDUAL AND CORPORATE TAX ID PETRALEX AGENCY . Students who receive taxable income as determined by the internal revenue service (i.e.

How to Apply for ITIN in 5 mins YouTube . Who should apply for an itin?

How to Apply for ITIN in 5 mins YouTube . Who should apply for an itin?

ITIN Number Application, Apply For Your ITIN Number Meru . During normal times, the best way to get an itin quickly, inside the tax season (january to april 15), is through a certified acceptance agent (caa).

ITIN Number Application, Apply For Your ITIN Number Meru . During normal times, the best way to get an itin quickly, inside the tax season (january to april 15), is through a certified acceptance agent (caa).

What is an ITIN? 5 Steps to Apply for an ITIN (Stepby . You’re not supposed to do them separately because oftentimes, the dependent or the spouse doesn’t qualify to apply for an itin on their own.

What is an ITIN? 5 Steps to Apply for an ITIN (Stepby . You’re not supposed to do them separately because oftentimes, the dependent or the spouse doesn’t qualify to apply for an itin on their own.

How to apply for a U.S. ITIN from Canada? Maroof HS CPA . And if you do have income that you are making, you are allowed to report it and you pay tax on it or try to pay tax on it.

How to apply for a U.S. ITIN from Canada? Maroof HS CPA . And if you do have income that you are making, you are allowed to report it and you pay tax on it or try to pay tax on it.