5 Unassuming How To Get A Copy Of Tax Returns Latest

10 Amazing How To Get A Copy Of Tax Returns - Records are generally kept for the previous three years. If it’s your first time using cash app taxes, you’ll create a password.

How to Get a Copy of Your Tax Return or Transcript The . Not only will it help your lawyer or forensic accountant uncover hidden assets , give you proof of your spouse's income, and reveal retirement accounts, it can also help you in the event of an irs audit.

How to Get a Copy of Your Tax Return or Transcript The . Not only will it help your lawyer or forensic accountant uncover hidden assets , give you proof of your spouse's income, and reveal retirement accounts, it can also help you in the event of an irs audit.

How to get a copy of tax returns

13 Absolute How To Get A Copy Of Tax Returns. Download the full pdf with all the forms and worksheets. A tax transcript is free. Get copies and transcripts of your tax returns you may need a copy or a transcript of a prior year's tax return. How to get a copy of tax returns

You should complete form 4506 and mail it to the address listed in the instructions, along with a $43 fee for each tax return requested. Find out how to get a copy and how it can help you. If you’re working on your tax return, you might want to check over your previous returns at the same time. How to get a copy of tax returns

A spouse filing a joint return is automatically entitled to a copy of the return. The copy of the return is made upon request by the irs. Here is a detailed discourse on how to get an itr copy online. How to get a copy of tax returns

Only the signature from the requesting spouse is required on the form 4506, request for copy of tax return. Here's an alternate way to print by opening the filed return back up to print at the print center, where you can also get the worksheets. Tax preparation software plans typically allow you to access returns prepared for at least the past three years. How to get a copy of tax returns

Log in and at the tax home or in the section your tax returns & documents for 2020, look for a link add. Get a copy of a tax return mail the following items to get an exact copy of a prior year. Copies of past tax returns, on the other hand, may cost you. How to get a copy of tax returns

While working on your tax return, for one reason or another Then, just access the prior years link in the taxes section. In comparison, the irs charges $50.00/per return copy for any return, no matter what year. How to get a copy of tax returns

As the leader in tax preparation, more federal returns are prepared with turbotax than any other tax preparation provider. On jointly filed tax returns, either spouse may request a copy. You need to contact the personal representative of the decedent, @scoot99., or whoever filed the final income tax return for the decedent and/or estate/trust income tax return. How to get a copy of tax returns

Enter your user id, password, and the security code to sign in to your account. For example, if you filed your tax return online, you should be able to get a copy of previously filed returns. The irs calls your past returns your “transcripts,” and it is easy to get them. How to get a copy of tax returns

Tax returns prior to these years are archived and if you filed these returns with efile.com, they can be obtained via your personal support page. On the next page, click on “view returns/forms.”. Include your full name, complete current mailing address and the tax year with your request. How to get a copy of tax returns

After we receive your request, we’ll get your returns from credit karma tax to you as soon as we can. Request for copy of tax form. Individuals should generally keep copies of their tax returns How to get a copy of tax returns

For poa information visit, power of. Then select “request a copy of tax return”. Get a paper or online version of 2021 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. How to get a copy of tax returns

Learn how to get each one. Getting a copy of tax return data for at least the three previous tax years is important when going through divorce, especially if you signed the returns without looking at them. How to get copies of tax returns for a deceased person? How to get a copy of tax returns

In compelling instances, such as child support cases, a judge may issue a court order requiring the release of another person's tax returns. There will a cover letter that says turbo tax. To navigate to your tax return forms yourself, follow. How to get a copy of tax returns

America’s #1 tax preparation provider: When you print your tax form pdfs, two additional pages will be included. Based upon irs sole proprietor data as of 2020, tax year 2019. How to get a copy of tax returns

Please send me my tax returns i filed with credit karma tax. Click on the above link and follow these steps: They can be obtained at $9.95/per return copy. How to get a copy of tax returns

How do you get a notarized copy of your tax return from your past? Contact an efile taxpert for archived efile.com return copies. The first page is the tax packet coverage and the second page is a copy of our audit defense policy. How to get a copy of tax returns

/tax_forms-56b810e45f9b5829f83d9167.jpg) How to Get Copies of Your Past Tax Returns . The first page is the tax packet coverage and the second page is a copy of our audit defense policy.

How to Get Copies of Your Past Tax Returns . The first page is the tax packet coverage and the second page is a copy of our audit defense policy.

IRS Form 4506T How to Get a Copy of Your Tax Return . Contact an efile taxpert for archived efile.com return copies.

IRS Form 4506T How to Get a Copy of Your Tax Return . Contact an efile taxpert for archived efile.com return copies.

How to Get a Copy of Your W‐2 from the IRS Irs, Tax . How do you get a notarized copy of your tax return from your past?

How to Get a Copy of Your W‐2 from the IRS Irs, Tax . How do you get a notarized copy of your tax return from your past?

How to Get a Copy of W2 Form from Prior Years PriorTax . They can be obtained at $9.95/per return copy.

How to Avoid These 10 Common IRS Mistakes on Tax Return? . Click on the above link and follow these steps:

How to Avoid These 10 Common IRS Mistakes on Tax Return? . Click on the above link and follow these steps:

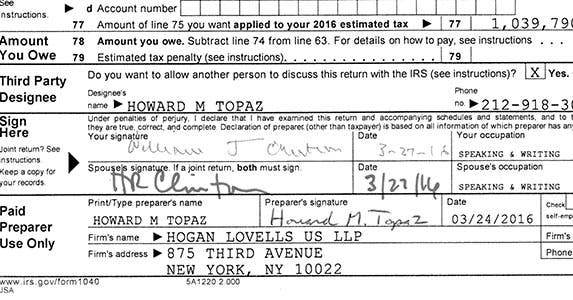

12 Tax Tips We Learned from Clinton's Tax Return . Please send me my tax returns i filed with credit karma tax.

12 Tax Tips We Learned from Clinton's Tax Return . Please send me my tax returns i filed with credit karma tax.